An introduction to synthetic indices trading

What are synthetic indices?

Synthetic indices are unique indices that mimic real-world market movement but with a twist — they are not affected by real-world events. These indices are based on a cryptographically secure random number generator, have constant volatility, and are free of market and liquidity risks.

Why trade synthetic indices

Synthetic indices offer tight spreads and leveraged trades. If you’d like to give synthetic indices a try, you can trade them on Deriv. Depending on your risk appetite, you can try trading Deriv’s proprietary synthetic indices using trade types such as CFDs, options, and multipliers.

Trading synthetic indices give you additional advantages, including:

- You’re aware of the potential risks right from the beginning; you won’t be surprised by unexpected margin calls. Margin calls occur when the balance on your account drops below your margin requirements, resulting in your positions become at risk of being closed automatically. You can fix the situation in two ways — deposit enough funds to increase your equity or close your positions.

- You don’t need a lot of capital to start trading.

- You benefit from the fast order execution and deep liquidity at all times, which is attractive for all traders, whether small or large.

- You can trade these indices 24/7, including weekends and holidays.

- There are different levels of volatility — Volatility 10 Index, Volatility 25 Index, Volatility 50 Index, Volatility 75 Index, and Volatility 100 Index.

In the Volatility 10 Index, the volatility is kept at 10%, which is an excellent choice for traders who prefer low price swings or fluctuations. With the Volatility 100 index, the volatility is maintained at 100%, meaning there are much stronger price swings and no significant price gaps. They are continuous indices with deep liquidity.

Platforms to trade synthetic indices on Deriv

Here are the Deriv platforms where you can trade synthetic indices.

DTrader

DTrader is Deriv’s powerful, easy-to-use trading platform. You can trade synthetic indices with options and multipliers on this platform, either via a desktop or a mobile device.

Trading synthetic indices on DTrader also allows you to manage your trades however you want.

You can choose not only the volatility level but also the contract length. You may open positions at a stake of as low as $0.35 and set the durations for as short as a second to several days.

You have the option of simultaneously opening multiple trades too. For example, you can open a Fall (sell) trade on the Volatility Index in 2 hours and a Rise (buy) trade on the same index in 2 minutes.

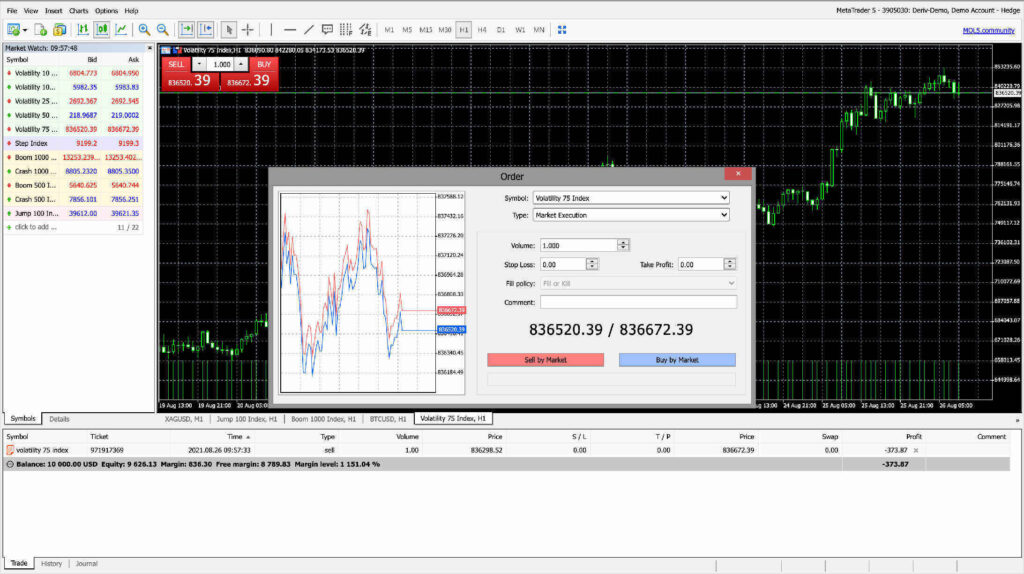

Deriv MT5 (DMT5)

Basam Trade Mentorship Program

FOREX AND SYNTHETIC INDICES MENTORSHIP

Never loss in your trading of Forex and Synthetic Indices again!

Trade with 90% winning rate on any currency pairs or synthetic indices assets using any of the strategy discussed in this book.

You also get the chance to ask the author questions on any confusion you might encounter while reading the book.

The course is available for everyone who is finding it difficult to trade Forex and Synthetic indices profitably a complete novice can also be mentored to perfection on enrolling.

- VIsible entry point determination

- Visible stop loss placement

- When to take profit

- How to manage trading psychology